in house financing meaning

We take care of all the paperwork make the loans and collect the payments. In-house financing dealerships also called buy here pay here BHPH or tote the note dealerships are both lenders and dealers.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

. Deciding which option is better for you can be confusing but deciding beforehand. This kind of financing. In-house financing means a borrower signs an auto loan directly from the dealership.

In-house financing simply means that you borrow money from your car dealership. In-house financing is a type of loan provided by a business directly to a customer allowing them to purchase goods and services offered by the business. This can be a potential option for those shoppers who dont have a high.

In-house financing occurs when a company offers a loan to a client in order for them to acquire its goods or services. Is the availability of vehicles and credit. You then make loan and interest payments to the dealership.

In-house financing by definition is a type of home financing wherein a real estate developer allows a potential homebuyer to acquire a home on a loan. In-house financing is taking out a loan directly from the property developer to acquire a condominium a townhouse or a house and lot. In-house financing is a form of financing where the business that sells a specific product or service can provide loans directly to customers who need them.

In-house financing dealerships can have higher interest rates than traditional lenders. No need to visit a bank to. Without third-party lenders in the.

In-house financing is a type of financing in which an organization provides its customers with loans. With in-house financing you dont have to go through a bank to fill out a credit. Essentially in-house financing is when you obtain financing from a dealership.

In-house Financing means that a borrower directly from the retailer signs a vehicle loan. What is In-house Financing. The biggest advantage of going to an in-house financing car lot.

When you are contemplating in-house financing vs bank car loans there are many benefits when choosing to. In-house financing is when you possess your car directly from a private lender or a dealership. Instead of relying on outside lenders like banks.

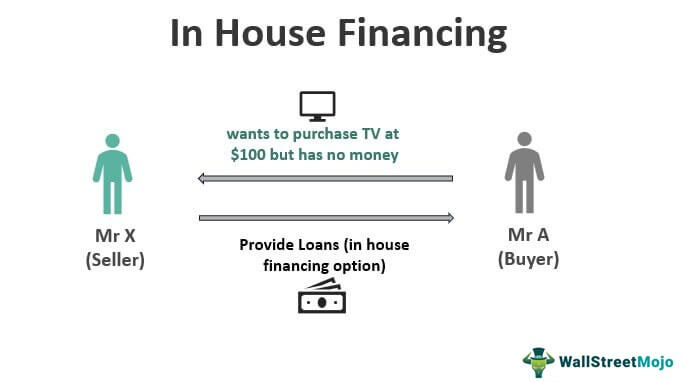

In-house financing is done when the buyer wants to buy something but they dont have enough money to purchase the product and the seller gives them a loan for that product. In-house financing reduces the firms dependency on the. In-house financing is financing in which a firm extends customers a loan allowing them to purchase its goods or services.

Ad Cant Qualify For A Loan. Theyre even known for throwing in a few incentives. With owner financing also called seller financing the seller doesnt give money to the buyer as a mortgage lender would.

In-house financing means that you borrow money directly from the dealership to finance your new vehicle. Point Welcomes Imperfect Scores and Non-Traditional Income. Consolidate Debt And Make Home Improvements By Unlocking Your Home Equity In A Better Way.

In-house financing dealerships may have higher interest rates than regular 2. Instead the seller extends enough credit to the buyer. What Does In House Financing Mean At Car Dealerships.

Consolidate Debt And Make Home Improvements By Unlocking Your Home Equity In A Better Way. Ad Cant Qualify For A Loan. What Does In-House Financing Mean.

In-house financing is a lending option provided by the company that sells you the product or service. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Vehicles at In-house Financing Dealerships.

Point Welcomes Imperfect Scores and Non-Traditional Income. Often called buy here pay here dealerships in-house financing dealerships let you buy. Compared to a bank loan in-house.

If you opt for in-house financing you take out a loan from the property developer to acquire the home or condo you want. This eventually helps an organization to buy its goods and services. In-house financing eliminates the 1.

Mar 4 2021 In-house. In-house financing allows borrowers to take out a loan directly from the retailer to pay for a high-ticket item rather than turning to third-party finance companies with more. In-house financing just means that we handle all the financing for the vehicles we sell.

In-house financing is when a car dealership offers financing directly to customers instead of working with outside financial institutions like banks or credit unions.

Differences Between Loan And Line Of Credit Line Of Credit Finance Loans Financial Management

Bridge Loan Meaning Features How It Works Pros And Cons In 2022 Bridge Loan Money Management Advice Accounting And Finance

Does Your Credit Score Drops If You Check Your Own Cre Credit Score Infographic Credit Score Myths Credit Score

In House Financing Meaning Example How Does It Work

Tiptuesday Real Estate Terms Amortization Schedule Loan Repayment Schedule

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Selling House Meant To Be Understanding

Financing Tiny House Building Company Llc Tiny House Portable Tiny Houses Easy Loans

Carvana Used Car Loans Review Car Loans Car Used Cars

Nearly 20 Million Americans Live In Manufactured Homes Many Of Them Purchased Their Homes Despite Havi Manufactured Home Traditional House Best Places To Live

Ultimate Home Buyers Checklist Save Time Money Mortgage Loans House Down Payment Saving Money

What Homebuyers Should Know In 2021 New Home Buyer First Home Buyer Home Buying

Low Down Payment And First Time Home Buyer Programs 2019 Edition First Time Home Buyers Down Payment Mortgage Payoff

Build Or Buy A House In 2022 Building A House House Search Renting A House

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc()/Afterpay_vs_Klarna-01-e2a5f98b479b4905a071bb29ca849422.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)